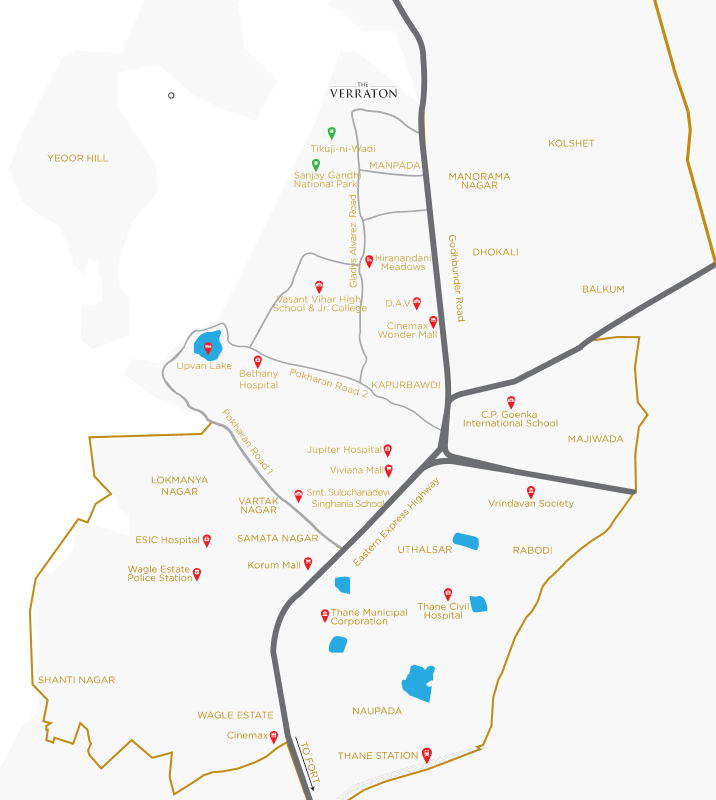

Welcome to 'The Verraton'- A bungalow living experience, where your manifestation turns into reality. Nestled in the embrace of mother nature, The Verraton by T. Bhimjyani is not just a residential project; dreams come true.

Imagine a world where conventional is transformed, giving you an immersive experience where luxury living paints the sky with the promises of convenience, redefining your expectations. Indulge in a lifestyle where you wake up to a landscape that gives you a view, recreating the magnificent beauty of Santorini to the mesmerising scenario of Florida.

Discover a haven, elevating your standards with the capturing view of Yeoor Hills and transporting you to another realm of the world that transforms your life beyond the ordinary.

T Bhimjyani Realty was founded by Tulsi Bhimjyani- formerly a part of the Neelkanth Group after 40 years in the real estate industry. It is not just a real estate company, it's an architect of dreams and stands as a beacon of success in this industry.

A commitment towards quality, customer-centricity and goodwill witnessing building of not just homes but a whole world.

We believe in curating luxury living spaces with convenience as our top priority across Mumbai. We endeavour to mark history with a vision of creating sustainable, vibrant, and inclusive spaces that gives you an extravagant living experience.